Gibson’s Creditors Want Change in Leadership

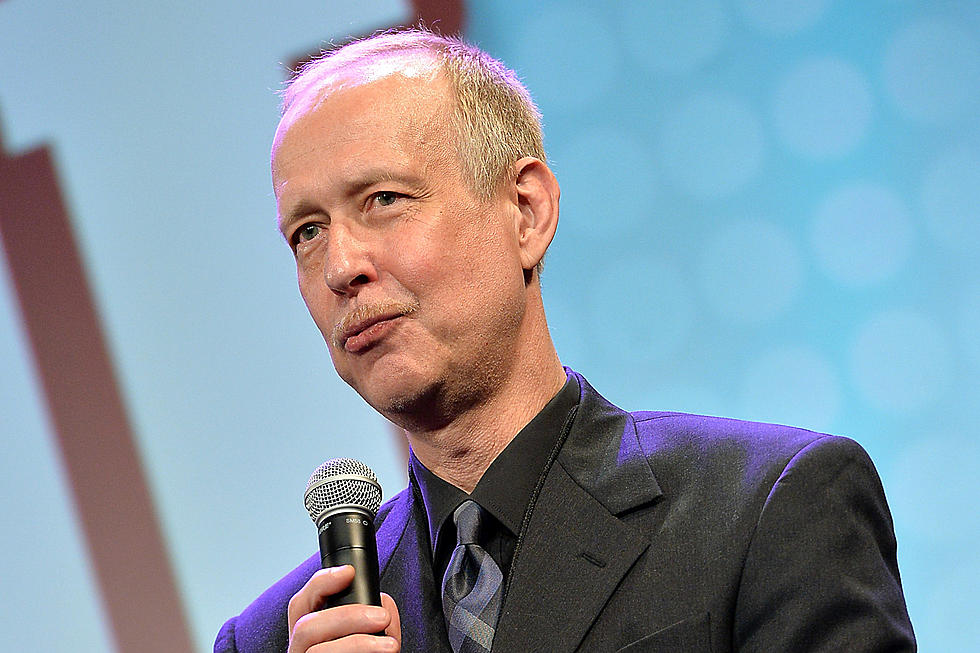

As Gibson's deadlines to meet its financial obligations inch closer, the group that holds the bulk of the guitar company's debt has said it's willing to restructure its deal, but there's a condition: Gibson's current CEO, Henry Juszkiewicz, cannot remain in charge.

Unnamed sources tell Bloomberg that they don't think Gibson will be able to bring in the necessary funds by July, when their notes are due, and the creditors don't want to invest any more money while Juszkiewicz remains at the helm. They've come up with a deal that would put control of the company in the hands of the bondholders and reduce the management's ownership stake. However, Juszkiewicz has said that he has no plans to cede control of the company he's run since 1986.

Rather than work with the bondholders, who he claims have "have other intentions that are not necessarily my intentions," Juszkiewicz has enlisted Jeffries Group LLC to work on a refinancing package that will wipe out the existing debt. Currently, they have a $375 million bond due on July 23, and it will trigger $145 million to be added to that total if it's not paid in full by then.

Bloomberg says that a good portion of that debt comes from an attempt to branch out into consumer electronics that didn't pan out as they had hoped, while Juszkiewicz placed the blame on the music retail industry's inability to fully recover from the economic crisis in 2008, adding that guitar stores could improve sales if they shifted their focus from catering to regular customers to making new ones feel welcome.

Earlier this week, it was reported that Gibson laid off 15 of the 100 employees at its Custom Shop in Nashville and had is corporate credit rating downgraded from "CCC" to "CCC-" by Standard & Poor’s.

The Flying V Turns 60: 25 Rock Stars With Gibson's Famous Guitar

More From Ultimate Classic Rock