How the Rolling Stones, Rod Stewart and David Bowie Ran From the Taxman

Tax season is unpleasant for everyone (except for the IRS, that is). But imagine the plight of many popular British bands in the '60s and '70s. In the U.K., the new millionaires had to pay a whopping 95 percent of their income in taxes. The Beatles’ George Harrison wrote "Taxman" to protest the unfair split: “There’s one for you, 19 for me.”

“‘Taxman’ was when I first realized that even though we had started earning money, we were actually giving most of it away in taxes,” Harrison said in 1980's I Me Mine. “It was and is still typical.”

Many rock stars in this time became "tax exiles," whereby they established residence in a country with a considerably lower tax rate until they could pay off their debt. The Rolling Stones were one of the first to employ the practice when they moved to France in 1971, and the trip also led to the title of their classic LP Exile on Main St.

“Back in the '70s taxes were a lot higher worldwide than they are today and there was something anti-establishment about being a tax exile,” says Nicholas Shaxson, author of Treasure Islands: Uncovering the Damage of Offshore Banking and Tax Havens. “Tax havens had this kind of James Bond image, this frisson of excitement and spies. Now, in Britain and many countries, tax dodging has gone a lot more mainstream and is a lot more part of the establishment.”

In the ‘70s and '80s many rockers, at least temporarily, encamped to tax havens around the world. David Bowie and Marc Bolan moved to Switzerland; Cat Stevens to Brazil; and Rod Stewart and Bad Company to California. Ringo Starr moved to Monte Carlo in 1975; in an interview, he told Howard Stern he pays "zero taxes."Even the Police's frontman Sting, who sang, “I don’t wanna be no tax exile” in 1978’s "Dead End Job," left for Ireland two years later.

Today, musicians set up their bands as corporations in tax havens like the Netherlands, Luxembourg and the British Virgin Islands. “They hire financial advisers to find pathways through the international tax system to escape tax,” says Shaxson. “At the end of the day, it’s usually about finding loopholes.”

But back in the day, many rock stars purchased one-way tickets out of London’s Heathrow airport. Here are the stories behind some of the most famous tax exiles in the rock world.

Listen to the Rolling Stones' 'Torn and Frayed'

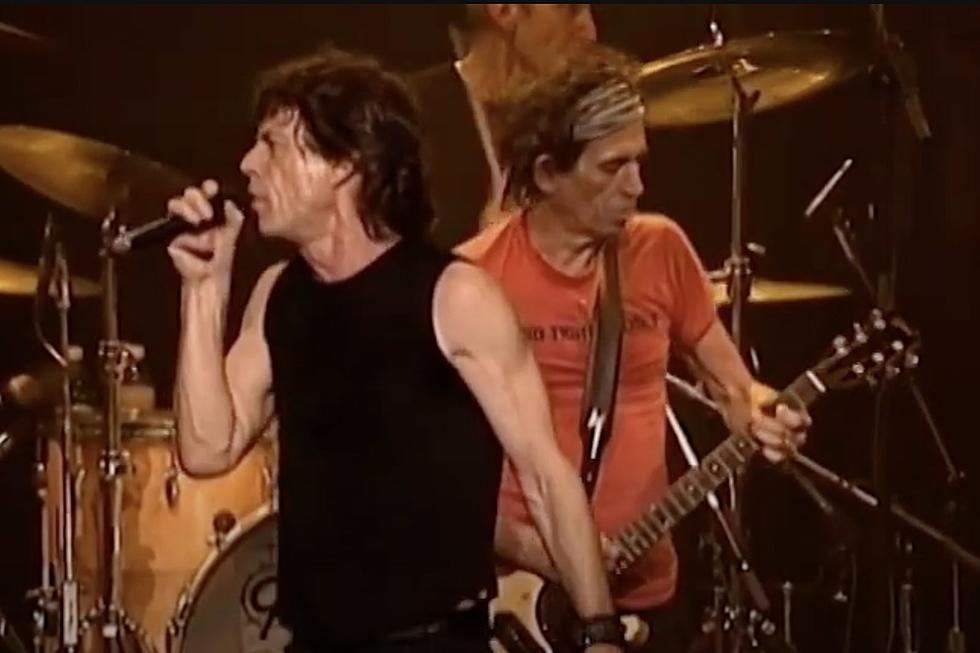

The Rolling Stones

Though they sold millions of records in the ‘60s, poor management decisions left the Rolling Stones almost broke by 1971. “In the early days, you got paid absolutely nothing,” Mick Jagger told Fortune magazine in 2002. “I'll never forget the deals I did in the '60s, which were just terrible. ... You say, ‘Oh, I'm a creative person, I won't worry about this.’ But that just doesn't work. Because everyone would just steal every penny you've got.”

Each of the Stones owed the British government a quarter of a million dollars in taxes, a huge sum at the time. They decided to move the band to France to avoid taxes and shelter their earnings in a Netherlands holding company.

“We had to leave England to acquire enough money to pay the taxes because in those days, in England, the high tax rate was 90 percent, so that's very hard,” Jagger told CNN. “You made 100 pounds, they took 90. So it was very difficult to pay any debts back. So when we left the country, we would get more than the 10 pounds out of 100. You know, we might get 50 or something.”

The move proved to be both a creative and financial success. Exile on Main St., whose early recording sessions in the basement of Keith Richards’ villa near Nice practically defined rock decadence, is one of rock’s greatest albums.

More than 40 years later, Jagger and Richards remain tax exiles, only allowed to spend a few months a year in the U.K. Jagger commutes between homes in London, France and the West Indies; Richards lives in Connecticut. “The whole business thing is predicated a lot on the tax laws,” Richards told the New Yorker. He made no excuses or apologies about leaving Britain because of its tax rates. “We left, and they lost out. No taxes at all.”

Watch David Bowie Perform 'Ashes to Ashes'

David Bowie

David Bowie moved to Switzerland in 1976 after a stop in the United States. Angela Bowie, the glam rocker’s wife at the time, wrote in her memoir Backstage Passes that Bowie had to leave to avoid paying increasingly hefty taxes.

“If David were to remain a resident of California, he would have to pay a hefty tax bill – $300,000 was the figure I was told – with money he didn’t have. As I understood it, these were tax debts accumulated over the previous few years, during which time vast quantities of taxable cash he had generated had vanished into various murky areas.”

Educated in Switzerland, Angela negotiated their move to the Alpine tax haven. “I got what we wanted, and better: legal residency in Blonay, a charming village above Lake Geneva, near Montreux in the French-speaking part of the country ... and an almost ludicrously low tax rate of about 10 percent.

“The Swiss take their residency requirements seriously and demand that their resident foreigners spend significant amounts of time at ‘home.’ Therefore you ‘stay’ or ‘work’ or ‘holiday’ in your London flat, Berlin garret, or wherever, and return to Switzerland when you have to. It’s like being on work release from a very nice, court-ordered health resort.”

While living in Geneva, Bowie began spending a lot of time in West Berlin. By the end of the year, he moved to the West German city and created his acclaimed "Berlin Trilogy" of albums: Low, Heroes and Lodger.

Watch Rod Stewart Perform 'Sailing

Rod Stewart

Rod Stewart made clear in a 1974 Melody Maker interview that he would leave the U.K. over its tax rates. “The Government thinks it'll tax us bastards right up to the hilt because we won't leave, but that's wrong because I will if I want to … with a 90 percent tax ceiling, it's just not worth living in England anymore.”

Stewart made good on his threat the next year when he and actress Britt Ekland moved to Los Angeles. “In April 1975, when my relationship with Britt was just getting going, I left England and became a tax exile,” Stewart wrote in Rod: The Autobiography. “This didn’t go down particularly well with the British press, who thought I was betraying the land of my birth. It didn’t go down especially well with Elton John, either. Round at his place one evening, I told him I was thinking of quitting Britain, and he called me a traitor and put on Elgar’s “Pomp and Circumstance Marches��� at a volume so high that we couldn’t talk over it.”

That year, Stewart explained to Rolling Stone why avoiding the taxman was so important. “You know, they don't seem to understand. You only get one bite of the apple. I can't be doing this for the rest of me life. I don't want to do it for the rest of me life. You do an apprenticeship for seven or eight years like I've done – well, like everyone's done – an’ then you earn a lot of money in one year and they want to take 90 percent away. I mean, I'd stay. Just leave me a little bit; just enough to get by on. But 98 percent – Christ!”

Stewart's decision to leave Britain was reflected in the title of his 1975 album, Atlantic Crossing. He still lives in Beverly Hills.

Top 100 Live Albums

Gallery Credit: UCR Staff

See Rod Stewart's Spouse in Our Video of Rock's Hottest Wives

More From Ultimate Classic Rock